Why Crypto Swap Apps Are the Future of Decentralized Trading

In 2025, decentralized exchanges are no longer a side story. They’ve become the headline. With trading volumes on Decentralized Exchanges (DEXs) exceeding $850 billion last quarter, it’s clear: decentralized trading has arrived.

For trading platforms and businesses, this isn’t just a tech trend. It’s a signal that crypto swap apps are now essential infrastructure. The ability to execute a token swap directly from a wallet, without intermediaries, is changing how traders think about speed, trust, and opportunity.

If your business still relies entirely on centralized systems, this article will show you why it’s time to rethink your strategy and how to use crypto swap technology to future-proof your trading operations.

What Exactly Is a Crypto Swap App?

Think of a crypto swap app as the next-generation version of a decentralized exchange (DEX). Instead of order books and custodial accounts, it uses smart contracts and liquidity pools to execute trades instantly.

Here’s the magic: users never lose custody of their assets.

The most general question is how the swap app works in crypto.

For that, traders have to follow these steps.

-

They connect a crypto wallet.

-

Choose the tokens they want to exchange

-

Enter the wallet address (smart contract)

-

The swap happens on-chain

For your business, that means no deposit delays, no withdrawal bottlenecks, and fewer compliance headaches tied to asset custody. More importantly, it gives your users confidence, and their funds stay in their hands, not yours.

That’s one of the biggest benefits of decentralized exchanges (DEXs): transparency, autonomy, and freedom from middlemen.

Why Users Are Moving Toward Decentralized Trading?

Centralized platforms still dominate much of the crypto space, but cracks are showing there, too. Custodial risks, withdrawal limits, and opaque operations have made traders skeptical.

Decentralized trading, on the other hand, gives them the following:

-

Control – They hold their private keys and execute trades directly. No one can trespass on their digital assets.

-

Speed – No waiting for order-book matches or manual approvals. The revolution of blockchain technology makes transactions faster, even beyond human expectations.

-

Access – They can reach new tokens as soon as they’re launched. It means that if traders want to sell and buy viral meme coins or stable coins, they can manage their investment portfolio very easily.

For trading management businesses, this shift means users expect a different kind of experience — one that’s open, instant, and secure. A well-built crypto swap app positions you right where those expectations are heading.

Benefits of Decentralized Exchange Platforms

It’s a prime debate why DEX platforms are useful and how. Let’s explore its advantages:

-

Permissionless listings mean faster market entry

-

Liquidity pools and AMMs power instant trades

-

Cross-chain and aggregator trends enable broader trading

Here’s an understanding of these benefits.

-

Permissionless Listings Mean Faster Market Entry.

Here’s something every business should understand: decentralized trading moves faster because it’s permissionless.

How?

New projects no longer wait for centralized exchanges to approve listings. A swap app connected to a DEX can support new token pairs within hours of launch.

-

For example, you launched a new meme coin at 8.00 A.M. E.T. and the listing was approved at 8.20 A.M. E.T. This is instantaneous, and once the smart contract is verified, the trading pool is ready with a liquidity limit, and the token is ready to trade.

That means your users can be the first to access emerging assets, and your business can benefit from early-stage liquidity and trading fees.

Of course, speed must be balanced with caution. The faster listing process means you need reliable auditing tools and community vetting to protect your users from low-quality or fraudulent tokens. But if managed well, permissionless token access is an unmatched competitive advantage and considered a secure crypto swap best practice.

-

Liquidity Pools and AMMs Power Every Swap.

Under the hood of every crypto swap app are liquidity pools and automated market makers (AMMs).

It’s better to know what liquidity pools are.

Liquidity pools are collections of token pairs locked in smart contracts. When someone swaps, they’re trading against the pool, not another person. The AMM uses mathematical formulas to set the exchange rate based on pool balances.

This design eliminates waiting. Trades are instant and running 24/7.

For your business, it also opens new revenue paths. You can do the following for more expansion of your platform:

-

Incentivize users to become liquidity providers. This is a very common and interesting choice to opt for.

-

Earn fees from pool swaps. It is a popular option for most of the DEX platforms implemented to charge a certain amount on swap transactions.

-

Manage liquidity depth for better pricing and minimal slippage. The diversity of your liquidity pool can attract maximum traders to prefer your platform for token swaps rather than others.

In short, Liquidity pools and AMMs explain the simple thing: they make your app self-sustaining, scalable, and always available.

-

Cross-Chain Crypto Swap Trends Are the Next Frontier

Do you know the 2025’s biggest innovation? Cross-chain crypto swap trends. It is the ability to swap tokens across different blockchains from one interface.

You can say that it is the best feature of the crypto swapping apps.

Imagine your users moving between Ethereum, BNB Smart Chain, and Arbitrum with a single click. That’s what the latest DEX aggregators and bridge-enabled swap apps offer.

Cross-chain integration means your users no longer have to leave your platform to access other ecosystems. You retain traffic, capture more trading volume, and become a true multi-chain gateway.

It’s the difference between being a single-market platform and becoming a global trading ecosystem.

Now, let’s move forward towards another section: a mobile-friendly crypto swapping app requirement. It’s not just about the competition but user retention, too.

Why UX and Mobile-First Design Are Game Changers?

Here’s a hard truth: most DEXs lose 60% of new users within the first few minutes because of poor UX.

That’s where modern swap apps shine. They make token swap experiences simple, intuitive, and mobile-friendly. It means your crypto swap app user interface design has to be top-notch.

How?

Here’s the overview.

-

Your users should be able to connect a wallet, pick two tokens, and confirm a swap in less than 30 seconds. That’s the benchmark.

A mobile-first crypto swap app helps you reach traders who prefer mobile wallets, especially in emerging markets where mobile access is the default.

Keep this formula in mind: Better UX = higher adoption, better retention, and more daily transactions.

All these things are okay. But what about the revenue generation for DEX apps? Let’s get the answer.

Crypto Swap App Monetization: New Token and Revenue Models

When you build a crypto swap app, you also unlock entirely new monetization models that don’t exist in centralized setups.

Here’s how:

-

Swap Fees: Take a share of transaction fees from liquidity pools. For example, if a trader wants to swap 0.10 ETH to 507,000 PEPE coins, then you may charge around a 0.30-0.50% fee (including network, floating, and slippage rate) on the swap.

-

Native Tokens: Launch your own utility or governance token. This is a kind of fundraising model to keep your platform advanced, competitive, and secure for trading cryptocurrencies.

-

Liquidity Incentives: This option is useful to reward users for providing capital. After all, the entire DEX platform runs on the liquidity pool, and the diversity in it keeps the app more useful.

-

Token Launchpads: Host early-stage projects right in your app. This will attract the token launches that want to list on your platform, and you can charge a certain amount from them.

These models turn your swap app from a feature into a business engine — one that grows as your user base and liquidity expand.

Security, Audits, and MEV Protection: The Foundation of Trust

We know how important security is in crypto swapping. Because already the traders have to face a value fluctuation. If the platform is vulnerable to cyber attacks, it can create more obligations towards them.

So, it directly indicates users trust DEXs because they’re transparent — don’t break that trust.

Here are the best practices to follow for building a secure swapping application:

-

Smart Contract Audits from credible security firms. Don’t go with the free or tempting organizations that claim unrealistic things and facts. Check before giving the audit work to any of the smart contract audit entities.

-

MEV Protection to stop front-running or sandwich attacks. It is important to create a shield-like environment to prevent malicious actors like miners, validators, or bots from penetrating transactions and manipulating the algorithms.

-

Bug Bounty Programs to catch vulnerabilities early. This can be considered the best security practices to be followed in crypto swapping app development. From it, you can identify what’s going wrong and patch those issues before they are exposed to attackers.

-

Transparent Governance for upgrades and fees. Don’t be rude and unprofessional here. Clearly states all the fees included in the completion of the transaction. Also, mentioning the updates in the app, like features or other use cases, can be helpful to users.

In decentralized trading, your code is your credibility. Treat it like your brand reputation — because it is.

Security maintenance in the DEX platform is one thing, but what about the rules to be followed?

DEX Regulation: Turning Compliance into an Advantage

Decentralization doesn’t mean lawlessness. In other words, you have to follow the regulations to operate the platform without any bans and legal consequences.

Regulation is catching up fast, and forward-thinking businesses are imposing it.

But how to do it?

-

Integrating optional KYC modules

-

Clear audit trails

-

Tax-friendly reporting tools

These aspects can make your crypto swap app enterprise-ready. With this approach, businesses can attract institutions, not just retail users, and position their platform as compliant yet decentralized — a rare and valuable combination.

Why Trading Businesses Should Bet on Swap-First Apps Now?

The next 12 months will define who leads the decentralized market. If you wait until swap apps are mainstream, you’ll be competing against giants who already built theirs.

Start now — whether that means white-labeling an existing DEX engine, developing your own, or partnering with established liquidity protocols.

Building a crypto swap app today is like launching an exchange in 2016: early enough to grow, established enough to trust.

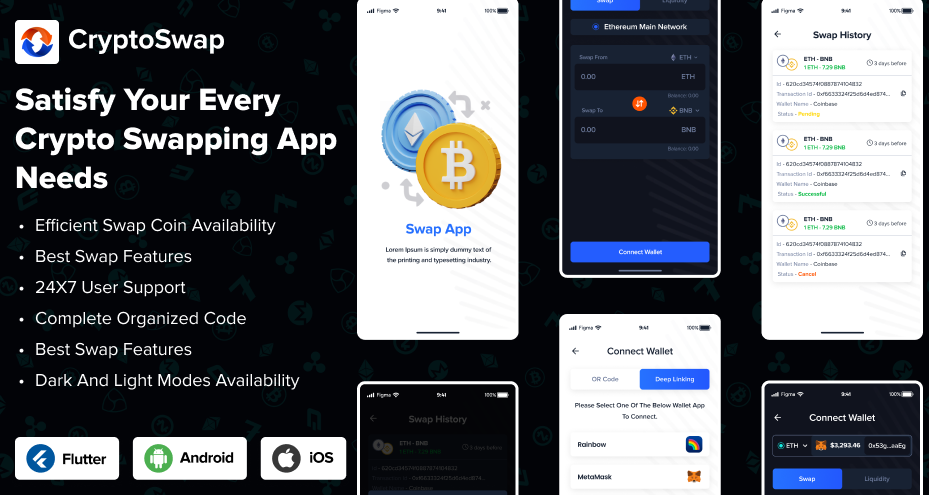

Looking for a smart, scalable, advanced, and cost-friendly solution to build your next DEX app?

Here’s the way we find for you: a Flutter-ready Crypto Swap App Template.

What’s included in this template:

-

Advanced UX-focused design

-

Dark/Light mode option

-

Important layouts ready (swap screen, market watchlist, portfolio, etc.)

-

Crypto wallet connect screen

-

Customizable source code

In short, if you’re looking to take your crypto trading and management business to the next level with the help of an agile web development option.

Final Thoughts

The future of decentralized trading belongs to platforms that combine control, simplicity, and security. A crypto swap app does exactly that — it helps users, diversifies your revenue, and opens doors to cross-chain markets.

For trading businesses ready to evolve, the next move is clear:

Don’t just trade on decentralized exchanges. Become one.

FAQs

-

What role do liquidity pools and AMMs play?

They’re the mechanism that enables instant swaps without needing a matching buyer or seller. Liquidity providers earn fees, and traders benefit from faster transactions.

-

What are the best practices for building a secure crypto swap app?

Through smart contract audits, MEV protection, permissioned upgrades, bug bounties, and transparency, you can make a swapping app secure. Treat your code as your trust anchor.

-

How can a Flutter app template be useful in app development?

With a Flutter template, you can get a front-end app development-ready solution, like UI/UX design, source code, and mobile optimization. However, to make it fully functional, backend development is required.

-

How much does it cost to make a crypto swapping app?

The average cost ranges between $10,000 and $500,000 for crypto swapping app development. It covers everything in the development life cycle, including UI design, feature implementation, blockchain integration, along the liquidity pool. The payment gateway integration is also included in this cost with smart contract audits.

-

Can I use a white-label solution or clone script for DEX platform development?

Yes, why not? The white-label solution is very useful to start the development without getting involved in repetitive tasks like UI designing and testing. All of these aspects have already been tested, which saves time and money. The crypto swapping app clone script, like Coinbase and Binance.

BTC - Bitcoin

BTC - Bitcoin

USDTERC20 - USDT ERC20

USDTERC20 - USDT ERC20

ETH - Ethereum

ETH - Ethereum

BNB - Binance

BNB - Binance

BCH - Bitcoin Cash

BCH - Bitcoin Cash

DOGE - Dogecoin

DOGE - Dogecoin

TRX - TRON

TRX - TRON

USDTTRC20 - USD TRC20

USDTTRC20 - USD TRC20

LTC - LiteCoin

LTC - LiteCoin