Build a Modern Escrow Platform: Templates vs. Custom Development

If you think an escrow platform development is just setting up the basic website with features, then you’re wrong. It relates to making a secure digital environment where multiple transactions can happen through pre-defined terms without any intermediaries. The question is whether a custom development is useful or if going with an escrow website template will be identical to project completion.

The answer depends on the priorities. As simple as that.

According to the report, by 2028, the escrow services market is projected to reach a value of $7.64 billion. It means a secure platform is more important than ever.

In this article, we’ll understand everything related to making a secure escrow website in possible ways: 1. Custom development and 2. Premium templates. With a clear, practical roadmap to the best solution for their next escrow project development.

Let’s recap from the foundation.

What is an Escrow Platform?

An escrow platform serves as a trusted digital intermediary in online transactions, holding funds securely until both parties fulfill agreed-upon terms. Unlike a simple payment gateway, escrow websites are designed to protect both the buyer and seller by minimizing risks such as fraud, non-payment, or product misrepresentation.

In practice, an escrow platform works like this:

-

The buyer deposits the agreed payment into the escrow account.

-

The seller delivers the product or service.

-

Once the buyer confirms satisfaction, the platform releases the funds to the seller.

This step-by-step process prevents disputes and builds confidence, especially in industries where trust is fragile, such as freelancing marketplaces, real estate transactions, or cross-border B2B trade.

From a developer’s perspective, building an escrow site isn’t just about implementing payment flows. Key aspects include:

-

Secure multi-party workflows that guarantee no party can withdraw funds prematurely.

-

Automated transaction monitoring to ensure deadlines and terms are met.

-

Comprehensive audit trails for legal and regulatory compliance.

-

Customizable dispute resolution mechanisms to handle exceptions.

With global e-commerce projected to surpass $7.5 trillion in sales by 2025 (Statista), the demand for reliable escrow services is expected to continue rising. Developers building these platforms need to balance security, speed, usability, and cost-effectiveness.

Next, we’ll explore when it makes sense to go with custom development for an escrow platform—and what you should consider if you take that route.

Use Custom Development for the Escrow Website

When your business requires a highly specialized escrow platform design, custom website development is often the go-to solution. Unlike generic templates, custom development gives developers full control over every feature and workflow—perfect for businesses with complex, industry-specific needs.

Get Website Development Service

Why Choose Custom Development?

Here are the reasons to prefer a personalized development for the escrow platform:

-

Tailored Functionality

With custom development, you can design features that reflect your exact business model. For example, you might need multi-party escrow services, advanced milestone payments, or integration with third-party identity verification services. These specialized features aren’t typically supported by free templates.

-

Robust Security Measures

Security is paramount in any financial service, and more so in escrow platforms. Custom solutions allow developers to implement advanced security layers, such as multi-factor authentication (MFA), custom encryption protocols, and compliance with regional financial regulations like GDPR or PCI-DSS.

-

Seamless Scalability

A well-architected custom escrow platform can handle rapid growth. Whether your platform will scale from hundreds of transactions per month to millions, a custom-built solution enables the use of microservices, load balancers, and efficient database structures tailored for high performance.

-

Full Compliance Readiness

Financial regulations vary by country and industry. Custom development allows precise control to build compliance features such as KYC (Know Your Customer) workflows, anti-money laundering (AML) checks, and region-specific tax calculations directly into your escrow platform.

The Drawbacks to Consider

While powerful, custom development is not without trade-offs:

-

Higher Costs: Developing from scratch often costs between $30,000 and $150,000, depending on complexity, as reported by industry surveys from Clutch.co.

-

Longer Time to Market: Building a custom escrow platform typically takes 6 to 12 months—a significant factor for startups seeking fast entry to market.

-

Ongoing Maintenance Needs: Post-launch, maintaining a custom platform demands a dedicated development team to handle security updates, bug fixes, and feature enhancements.

When Is Custom Development the Right Choice?

Custom development makes sense when your business:

-

Requires advanced escrow workflows not supported by templates (e.g., multi-party splitting, automated dispute resolution).

-

Handles highly sensitive industries like real estate or cross-border trade, where regulatory compliance is mandatory.

-

Plans to scale significantly over time.

-

Has a long-term budget allocated for development and maintenance.

For developers focused on delivering an advanced, secure, and future-proof escrow website, custom development provides the flexibility to innovate without limits.

Next, we’ll take a closer look at using a ready-made escrow template for small business development and why it’s a proper and smarter choice.

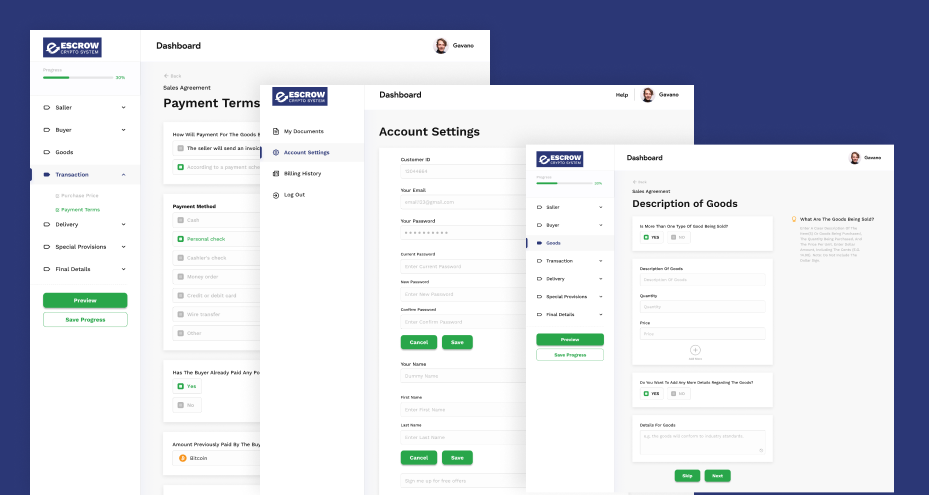

Use a Ready-Made Template for the Escrow Website Development

For many developers building an escrow platform, especially for startups and small businesses, a ready-made website template presents an attractive solution. These templates provide a pre-built foundation that reduces complexity, cost, and development time while following industry-standard best practices.

Why Choose an Escrow Website Template?

Here are the reasons to prefer a premium template:

-

Cost-Effective Development

Unlike custom development, escrow templates are affordable. Prices typically range from $50 to $500, depending on the provider and included features. This makes them ideal for businesses looking to minimize upfront expenses while getting a functional escrow solution.

-

Faster Time to Market

Pre-built templates allow developers to bypass long development cycles. With well-documented code and built-in workflows, you can set up a functional escrow website in just a few weeks rather than months. This is particularly advantageous in fast-paced markets where speed matters.

-

Built-in Best Practices

Good escrow templates already follow the entire platform design, optimized with the best practices. These include responsive UI design, secure transaction flows, and simple admin panels to manage payments, users, and disputes. This reduces the chances of critical implementation mistakes and ensures a solid starting point.

-

Basic Compliance Support

Many premium website templates come with built-in features that cover basic compliance needs, such as KYC form integrations and GDPR-ready data handling processes. Though not as customizable as custom development, these templates help businesses meet minimum regulatory standards from day one.

-

Suitable for Small Businesses and Startups

An escrow website template for a small business is usually a smart choice when launching a new service. It offers enough functionality for initial market entry, allowing the business to test its model and gain early traction without heavy upfront investment.

The Limitations to Consider

Despite their benefits, escrow templates have some limitations:

-

Limited Customization: Most free emplates are designed to serve a broad audience. Adapting them to your specific business needs may require additional development, particularly for advanced workflows or integrations.

-

Generic Design and User Experience: Since templates are meant to cater to many businesses, the user experience may feel generic and less aligned with your brand identity. Go with the paid templates in frontend frameworks like Bootstrap, Tailwind CSS, React, backed by HTML5.

-

Security Concerns: Not every template is built with top-tier security in mind. Developers must carefully evaluate the source of the template, audit its code, and ensure it receives regular updates to address new vulnerabilities.

When Is a Template the Smarter Choice?

Templates are an excellent fit when your business:

-

Wants to build an escrow website quickly and start processing transactions within weeks.

-

Operates on a limited budget, prioritizing low-cost solutions.

-

Need to test the business idea before committing to full-scale custom development.

-

Doesn’t require complex workflows or deep integrations at launch.

Many successful startups began their journey using templates to validate their market fit before investing in custom solutions. By focusing on market entry first, they optimized resources while building credibility in the escrow space.

Next, we’ll provide a direct comparison between templates and custom development, helping developers make an informed decision.

Templates vs. Custom: A Direct Comparison

Choosing between escrow website templates vs custom development can be a tough decision for developers, especially when balancing budget, speed, and functionality. To help clarify the trade-offs, here’s a detailed comparison of the two approaches across key development factors:

|

Feature |

Custom Development |

Escrow Website Templates |

|

Cost |

High ($30,000–$150,000) |

Low ($50–$500) |

|

Time to Market |

6–12 months |

2–8 weeks |

|

Customization Flexibility |

Unlimited |

Limited by template structure |

|

Security Control |

Fully controllable |

Varies, requires auditing |

|

Scalability |

High |

Moderate, limited by design |

|

Compliance Integration |

Fully tailored to industry needs |

Basic features included, may require extra development |

|

Maintenance Requirements |

Requires a continuous support team |

Mostly self-managed or minimal support |

|

User Experience (UX) |

Fully branded and optimized |

Generic UX, minor branding possible |

|

Technical Skill Requirement |

High (developers needed) |

Low to medium (easy setup, minor adjustments) |

|

Future Upgradability |

Fully adaptable |

Possible, but may require rebuilding large parts |

Real-World Insights

According to Statista, 58% of small businesses prefer a website template for developing a site. They reveal that due to cost-effectiveness and speed, they prefer a template to launch a site for their first digital products.

At the same time, businesses handling multiple transactions at a higher volume go with a custom development for long-term scalability.

Also, Deloitte finds that 40% of the mid-size financial companies need custom solutions to manage sensitive services like escrow. Their top priority is citing compliance and control.

Conclusion

Nowadays, creating a top-level escrow platform for clients is not complicated with smart solutions. For a startup, a template works better, and if the business needs to be involved in the B2B segment, a custom development is always the perfect choice.

At the end of the day, it’s about picking the solution that fits your goals. So, which path will you take? You have to decide it.

FAQs

-

What are the best frontend practices for escrow platform development?

Use React or Angular for a responsive UI, implement WebSockets for real-time updates, and apply Next.js for server-side rendering and SEO optimization. This tech stack ensures fast, mobile-friendly designs.

-

Which backend technologies are best for escrow website development?

Use Node.js (Express) or Django (Python) to build scalable APIs, handle asynchronous escrow workflows, and manage secure transaction logic to integrate robust logging and audit features.

-

What database is ideal for an escrow website?

Use PostgreSQL for structured escrow data with relational integrity and ACID compliance or MongoDB for flexible document storage. Implement audit logs for compliance and transparency.

-

How do I secure an escrow platform?

Implement SSL/TLS encryption, JWT-based authentication, multi-factor authentication (MFA), input validation, encrypted storage (e.g., AWS KMS), and regular dependency updates to safeguard sensitive financial data in the escrow platform.

-

How should I integrate payment gateways for escrow functionality?

Integrate payment services like Stripe, PayPal, or Razorpay via their APIs. Use secure webhooks to handle transaction updates and modular payment services for flexibility and multi-currency support.

BTC - Bitcoin

BTC - Bitcoin

USDTERC20 - USDT ERC20

USDTERC20 - USDT ERC20

ETH - Ethereum

ETH - Ethereum

BNB - Binance

BNB - Binance

BCH - Bitcoin Cash

BCH - Bitcoin Cash

DOGE - Dogecoin

DOGE - Dogecoin

TRX - TRON

TRX - TRON

USDTTRC20 - USD TRC20

USDTTRC20 - USD TRC20

LTC - LiteCoin

LTC - LiteCoin