How to Build a Cryptocurrency Exchange Platform from Scratch

Developing a secure cryptocurrency exchange platform like Binance and Coinbase is not as easy as you think. Behind the smooth trade transaction execution, the system works: a trading engine, secure Web3 wallets, blockchain integration, etc.

In this guide, we’ll take you step by step through how to build a cryptocurrency exchange platform from scratch, covering everything from architecture, security, and wallets to liquidity, UI/UX, and post-launch strategies. The same real-world workflows that professional blockchain developers rely on to create high-performance, trustworthy exchanges.

First, Understand the Core Concept of a Crypto Exchange.

Before you start website development, know how the mechanism works in real-time financial systems. Here, you have to understand managing user balances, executing trades instantly, securing digital assets, and interacting with multiple blockchains.

A functional exchange depends on four core components:

-

Trading Engine: Through the secure trading engine, it matches buy/sell orders and maintains the order book.

-

Wallet System: This includes managing hot, warm, and cold wallets securely for the trade process.

-

User Interface: The website user interface enables smooth trading, charting, deposits, and withdrawals.

-

Liquidity Layer: This ensures deep order books and stable pricing of listed tokens.

These fundamentals shape your technical choices, security model, and overall development approach.

Once the concept is clear, move forward with what kind of crypto exchange exists and what you have to prioritize.

Then, Define the Exchange Type You Want to Build.

There are three main models usually crypto exchanges usually have: 1. Centralized (CEX), 2. Decentralized (DEX), and 3. Hybrid exchanges. Opting for any one of these affects the decision of the entire architecture, compliance requirements, liquidity setup, and cost.

-

Centralized Crypto Exchange

This exchange gives you full control over custody, order execution, liquidity, and user management. This model offers the highest performance and revenue potential but also requires strict licensing and advanced security. Binance, Coinbase, and Gate.io are the prime examples of centralized crypto exchanges.

-

Decentralized Crypto Exchange

This type of exchange relies on smart contracts only. Users can trade cryptocurrencies without relinquishing custody of their tokens. DEX platform development is easier from a compliance perspective. But it is limited by blockchain speed, high gas fees, and fewer trading features. Pancakeswap, Uniswap, Orca, and Fluid are the top platforms for decentralized exchanges.

-

Hybrid Exchange

A Hybrid Exchange combines CEX-level performance with on-chain transparency. It’s ideal if you want faster transactions while allowing users more control over assets. Kraken, OKX, Binance, and Blum are examples of this kind of exchange.

Choosing the right type early prevents website redesign costs and improves development clarity across the team. It ensures that your business model solution aligns with user expectations.

Now, Conduct Market & Competitor Research.

You know what crypto exchange model you’re ready to go with. But, how? There’s a need to analyze what kind of competition is currently going on and the market conditions.

Here’s the approach you have to pay attention to:

-

Know where you want to go.

Start by identifying the regions. Check which countries have strong crypto adoption (e.g., Nigeria, U.S., EU). Then, understand regulatory clarity and active trading communities. This helps you determine the right features, supported assets, and compliance requirements.

-

Studying the competitors.

Next, analyze leading competitors like Binance, Coinbase, Kraken, and Bybit websites. Look closely at their onboarding flow, fee model, liquidity depth, trading UI, supported order types, and security measures.

Your goal is not to copy them but to identify gaps like slow verification, poor UX, high withdrawal fees, or limited fiat support. You can improve these types of issues in your platform.

-

Use behavior understanding.

Once done, then shift focus to the user behavior. Invest time to understand what traders expect, which features attract volume, and what discourages them from using your new platform.

-

Market research in a proper manner.

Doing market research validates whether you build an exchange with genuine demand or not, along with a strong value proposition. A competitive set of features sets you apart rather than just another generic trading platform.

Then, Plan Core Features and Functional Requirements.

Once your market direction is clear, the next step is defining the feature requirements of your exchange. This becomes the blueprint for designers, developers, and compliance teams.

-

User-side features

Here is a list of features that can be useful for traders:

-

Account creation

-

KYC verification

-

Multi-currency wallets

-

Deposit/withdraw options

-

Trading charts

-

Order types (market, limit, stop)

-

Transaction history, notifications)

-

API access for algorithmic traders

These features directly impact user experience and trading volume.

-

Admin features

To manage the exchange website, these admin-side features are required:

-

Plan for tools that manage users

-

Verify identities

-

Monitor liquidity

-

Configure trading pairs

-

Track system health

-

Adjust fees

-

Review security logs

-

Handle tickets

A strong admin panel provides smooth operations and reduces downtime of the crypto trading website.

In addition, you should also identify technical requirements early, like latency thresholds, real-time data flow, supported blockchains, wallet structure, and expected daily volume.

With clear functional planning, web development errors can be reduced, and a scalable architecture offered for a long-term operational advantage.

Know Legal Compliance, Licensing & Regulations of Crypto Exchange.

Starting a crypto exchange is not as easy as opening a shop and starting to sell the products and services. As it involves monetary systems, governments and organizations impose regulations on it. Here is the understanding of what you have to prioritize:

-

Geographical location for business operation.

Before launching, you must identify the regulatory requirements of the regions you plan to operate in. Most countries classify exchanges as Virtual Asset Service Providers (VASPs), which means you must follow KYC, AML, and CFT guidelines to prevent fraud and illegal activity.

-

Different licensing conditions.

Jurisdictions like Estonia, Lithuania, Dubai, Seychelles, and Singapore offer clearer regulatory pathways to operate a crypto exchange. The U.S. demands stricter approvals, including money transmitter licenses.

-

Security features.

Your exchange should integrate automated KYC verification, risk scoring, and AML screening from day one. These systems help monitor suspicious activity and maintain regulatory readiness during audits.

Now, Choose the Right Architecture & Technology Stack.

A secure and advanced crypto exchange web development architecture and technology stack lays the foundation of success and ignorance.

So, what should you do?

-

Select an architecture that prioritizes low latency, fault tolerance, and security.

-

Use a microservices approach so components (auth, order matching, wallet, KYC, market data) can scale independently and be deployed in containers (Docker + Kubernetes).

-

Design event-driven communication (Kafka, RabbitMQ) for order events, and use WebSockets / gRPC for real-time client updates.

Referring to the technology used depends on the exchange model you opted for:

| Technology | Example | What is it used for |

|---|---|---|

| Front-end |

|

|

| Back-end |

|

|

| Database & Caching |

|

|

| Storage & Space |

|

|

| Infrastructure |

|

|

This stack balances speed, reliability, and security for production-grade exchange development.

Then, Integrate a Reliable Liquidity Solution into the Platform.

After the tech stack, opting for an exchange, then a liquidity integration is required. Without it, orders fail, spreads widen, and users leave.

So, what’s the solution?

-

Start by combining external liquidity providers (LPs) and market makers (MMs) with an internal liquidity aggregation layer that routes orders to the best source in real time.

-

Implement an order-routing system that queries multiple venues (internal book, LP APIs, other exchanges) and chooses the best price considering slippage, fees, and latency.

-

For DEX or hybrid models, connect to AMM pools and liquidity aggregators (route across pools to reduce slippage).

-

Offer incentive programs (maker rebates, reduced fees) to attract MMs and provide initial depth.

-

Build an inventory management and risk-hedging module to automatically hedge large fills with external venues and maintain desired spreads.

-

Monitor liquidity health with metrics: depth at ±0.5%/1%, time-to-fill, and realized slippage.

-

Automate fallback behaviors (disable pair, widen spreads, switch LPs) when liquidity drops.

Liquidity brings trust to your platform, and it works like a magnet to attract crypto traders.

Next, Build a Secure Wallet Infrastructure.

A secure wallet system is one of the most important components of a crypto exchange. Your platform must safely store user assets while allowing fast deposits and withdrawals. This requires a layered wallet structure that separates operational funds from long-term storage.

-

Hot wallets: These wallets handle day-to-day withdrawals and must be protected with strict access controls, rate limits, and real-time monitoring.

-

Warm wallets: These wallets act as a buffer to replenish hot wallets automatically when balances drop.

-

Cold wallets: These wallets store the majority of assets offline and require multi-signature approval for every transaction. They remain untouched during cyberattacks.

Your wallet infrastructure should include automated reconciliation, transaction verification, address whitelisting, and fraud-detection rules to catch unusual withdrawal patterns. It has to be optimized for private keys that should never be exposed.

Now, Develop the Trading Engine.

The trading engine is the key to a crypto exchange, responsible for matching buy and sell orders and maintaining the order book.

Here is an overview of what to look for when making a trading engine for your crypto exchange.

-

Languages like Golang or C++ and event-driven architecture ensure low latency.

-

The engine integrates with wallets, liquidity providers, and the frontend to update balances and trade history instantly.

-

Risk management modules detect anomalies and prevent overselling. This makes the engine secure, fast, and reliable for traders.

In another way, you can integrate third-party APIs for the trading engine apart from custom development.

Focus on the Website UI and UX Design.

A clean, intuitive UI and UX are important for trader engagement. The platform should display real-time order books, live charts, and trading pairs clearly. With that deposit, withdrawal, and wallet management flows also have to be simple to perform.

Here is the best practice to follow:

-

Navigation should be smooth, with accessible trade history, open orders, and portfolio overviews.

-

Mobile responsiveness is essential, as many traders use smartphones.

-

Integrate fast, interactive charting tools like TradingView and provide easy order placement with clear confirmations.

Good UI/UX reduces errors, builds trust, and keeps users active. It is directly impacting trading volume and the platform’s reputation in a competitive market.

Now, Implement Security Measures on the Platform.

Security is important for any crypto exchange. You can’t ok with the compromise.

Follow this approach:

-

Protect user accounts with two-factor authentication, device management, and session tracking.

-

Encrypt sensitive data using AES-256 and secure all communications with TLS 1.3.

Wallets must use multi-signature approvals, hardware security modules, and cold storage for long-term funds.

-

Protect infrastructure with firewalls, DDoS mitigation, rate limiting, and continuous monitoring.

-

Conduct regular penetration tests and vulnerability scans to identify risks early.

-

Integrate fraud detection to monitor unusual trading or withdrawal activity.

A strong, multi-layered security framework safeguards assets, builds user trust, and ensures compliance with regulatory standards. This reduces the risk of hacks and operational losses.

Testing the Exchange for Performance and Security.

QA & Testing your crypto trading website checks that it performs reliably before going live.

-

Start with functional testing to validate every core action: sign-up, KYC, deposits, withdrawals, and order execution.

-

Then run performance and load tests to simulate high-traffic trading conditions and confirm the system can handle large volumes without slowing down.

-

Complete user acceptance testing (UAT) to verify that the platform feels smooth, intuitive, and stable across devices.

A thoroughly tested exchange reduces launch risks and builds user trust from day one.

Deployment, Hosting & Scaling of Crypto Exchange Website.

To go live on the web, you have to focus on the IT infrastructure.

-

Use cloud providers like AWS, GCP, or Azure with auto-scaling, load balancers, and redundancy to ensure high availability.

-

Containerize services with Docker and orchestrate with Kubernetes for flexible deployment.

-

Implement continuous integration and delivery (CI/CD) pipelines to push updates safely.

-

Monitor system performance with tools like Prometheus and Grafana, and maintain backups for disaster recovery.

-

Optimize databases and caching layers (Redis, PostgreSQL) for low latency.

Proper deployment and scaling strategies enable the exchange can handle traffic spikes, maintain uptime, and provide a seamless experience for thousands of concurrent traders.

Prepare Launch Strategy & Marketing in Crypto Exchange.

A strong launch strategy keeps your exchange gaining visibility and user trust from day one.

-

Begin with a private beta to test functionality and gather feedback.

-

Secure partnerships with liquidity providers and market makers before public launch.

-

Promote the platform through targeted campaigns, social media marketing, crypto communities, and PR announcements.

-

Consider referral programs, zero-fee trading periods, and incentives to attract early users.

-

Clearly communicate security measures, supported assets, and platform advantages to build credibility.

-

Create a crypto website SEO plan and then implement it.

A well-planned launch not only attracts traders but also establishes trust, liquidity, and momentum, setting the foundation for long-term growth.

Keep Post-Launch Maintenance Proper.

Continuous maintenance is important to keep your exchange secure, reliable, and competitive.

-

Regularly update the system with security patches, bug fixes, and feature improvements.

-

Monitor server performance, wallet activity, and trading engine health to prevent downtime.

-

Continuously audit liquidity, order books, and transaction flows to ensure accuracy and user trust.

-

Stay compliant by updating KYC/AML procedures and adhering to regulatory changes.

-

Provide responsive customer support and gather user feedback to improve functionality.

Ongoing maintenance, monitoring, and updates make the platform stable, secure, and attractive to traders. This supports long-term growth and credibility.

Conclusion

Building a cryptocurrency exchange platform from scratch is a complex but achievable endeavor. By following structured development practices, integrating secure wallets, and prioritizing both trader experience and regulatory adherence, you can create a scalable, competitive, and trustworthy crypto exchange. This can meet the demands of today’s digital asset market.

FAQs

-

How much does it cost Binance-like crypto exchange website?

A Binance-like exchange can cost from $5,000 using clone scripts to $150,000+ for custom development. This cost excludes compliance, security audits, and long-term maintenance.

-

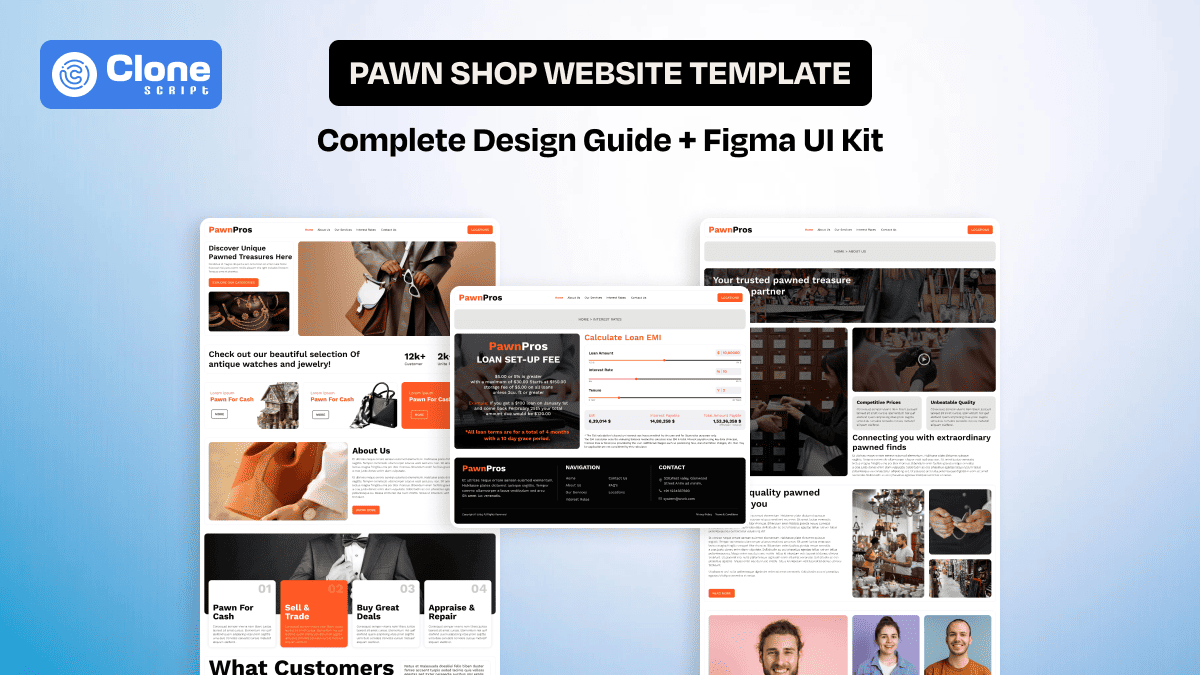

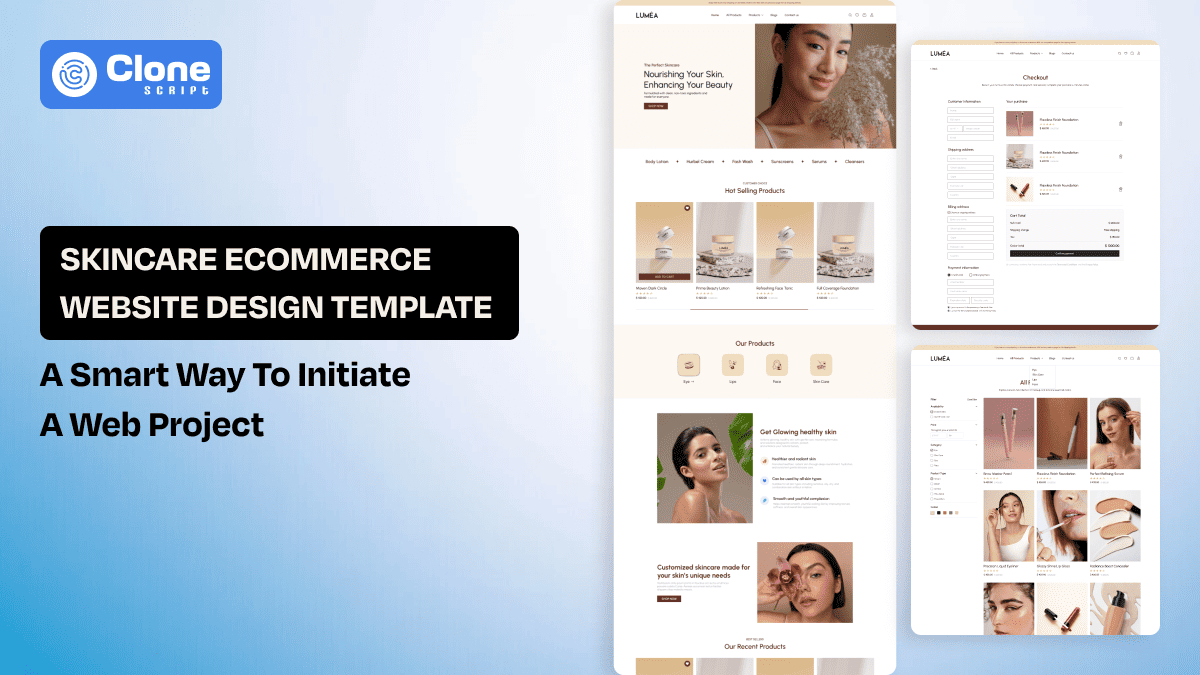

Are website templates useful for crypto exchange platform development?

Website templates help with basic UI and layout only; they cannot support trading engines, wallet systems, security, or blockchain integrations required for real crypto exchanges. It required additional development efforts.

-

Can I approach to Web3 development company or agency for an exchange?

Yes, a Web3 development company can handle exchange architecture, blockchain integration, security, compliance modules, and scalability. They’re the right choice for professional crypto exchange development.

-

Is a crypto exchange clone script useful for my business?

Crypto exchange app clone scripts are useful for quick launches and lower costs, but require customization, security hardening, and compliance support to become scalable, trustworthy business platforms.

-

What are the common features of a crypto exchange website?

Common features for crypto exchange websites include user authentication, KYC, trading engine, wallets, order book, liquidity management, admin dashboard, security layers, APIs, real-time charts, and deposit-withdrawal systems.

BTC - Bitcoin

BTC - Bitcoin

USDTERC20 - USDT ERC20

USDTERC20 - USDT ERC20

ETH - Ethereum

ETH - Ethereum

BNB - Binance

BNB - Binance

BCH - Bitcoin Cash

BCH - Bitcoin Cash

DOGE - Dogecoin

DOGE - Dogecoin

TRX - TRON

TRX - TRON

USDTTRC20 - USD TRC20

USDTTRC20 - USD TRC20

LTC - LiteCoin

LTC - LiteCoin